So, you have an idea for a business and want to know if it is possible to incorporate and run it by yourself as a physical person, even if you don’t have any employees. The short answer is YES.

When you form an LLC (limited liability company) for your business activities, you and your personal assets are protected from any liability the LLC may face. And, by default, the LLCs’ taxes “pass-through” to your personal taxes and are filed together. A single-owner LLC, more commonly known as a single-member LLC, can combine your personal taxes and your LLCs taxes on the same federal tax return.

Facing The Giants

We live in a society that is obsessed with news about behemoth corporations. It is easy to feel small and powerless in the shadow of these corporate behemoths. And you might have had doubts about whether it is possible to start a one-person company.

We are constantly informed about the latest business moves of companies like Tesla, Facebook, Ford, and Coca-Cola. These corporations have thousands of employees. Through mergers and acquisitions, each one of them has come to own several other companies, that each has its own set of employees.

So, what can you do amid all these giant corporations? Can you start from scratch all by yourself? Yes, absolutely, and the best corporate structure to do that is the LLC, which has been available in every state since 1996.

If you have doubts about whether your business venture will make it, remember that every household name brand began with just one person and an idea.

Starting A Business As A “Lone Wolf”

Can you form an official business entity, run the entire thing alone, without any employees, and still enjoy the corporate benefits that remove personal liability from the equation?

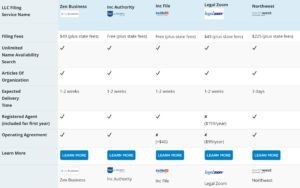

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

Absolutely! And the easiest way to get started is by forming an LLC in your state. The LLC business entity is the fastest-growing business structure in the US. Since 1996, when all 50 states adopted the LLC business structure, thousands of small-scale, creative entrepreneurs like you have started their own LLCs.

What makes the LLC business structure so attractive to solo entrepreneurs?

- simplified taxation

- simplified business requirements

- personal liability protection

How Does The IRS Treat An LLC When It Comes To Taxes?

By default, an LLC (limited liability company) LLC is treated by the IRS as a “disregarded entity.” This means that LLC’s profits and losses appear on the LLC owner’s federal tax return.

In legal language, an LLC’s owner is referred to as a “member.” An LLC can have multiple members as well as multiple members represented by a manager. In this case, the LLC is manager-managed. By default, LLCs are member-managed, whether they be single or multiple-member.

But for the sake of this article, we’re going to focus on the single-member LLC. In layman’s terms, that’s an LLC owned by one individual.

How Does The IRS View A Single Member LLC?

An individual who owns a single-member LLC is taxed the same as if he were operating as a sole proprietorship. The net earnings from a sole proprietorship and LLC are taxed similarly.

LLC Taxpayer Identification Number – Why You Need One

The IRS uses an EIN (Employer Identification Number) to handle your LLC’s federal taxation. The IRS states that most new single-member LLCs classified as disregarded entities must obtain an EIN.

Most banks require an EIN to open a business account in your LLCs name. You can get one for free as part of a done-for-you LLC formation package or by visiting the IRS website. You will need to have your LLC articles of incorporation ready to obtain an EIN.

Excise Taxes

Excise taxes are often included in the price of goods such as gasoline, cigarettes, and alcohol. They can also be applied to certain services like highway usage in the trucking industry and gambling.

An LLC is required to use its name and EIN to register for excise tax activities.

A Personal Tax Return, With Corporate Benefits

The simplicity of the LLC taxation structure makes it an attractive and practical business entity for solo entrepreneurs. Since the default taxation structure of a single-member LLC is a “disregarded entity,” the LLCs taxes flow through to the owner’s tax return. The owner enjoys the limited liability protection that the LLC offers and, at the same time, keeps things simple by having the LLCs taxes flow through their personal tax return.

In this fashion, double taxation is also avoided. In a double taxation scenario, the taxes from the same income source would be paid once at the corporate level and again at the personal level. With the default LLC corporate structure (disregarded entity), the corporate and personal taxes are the same.