According to a Tax Foundation publication made in 2014, the total number of businesses owned by individuals surpassed the total number of corporations. Since the 1980s, the trend seems to support the existence of more individual-owned businesses in various forms. One of the more popular business entities is the LLC with one member.

Within this distinction, sole proprietorships have taken the lead. In fact, the Tax Foundation recorded that out of over 30 million individually-owned businesses, 23 million were sole proprietorships.

If you are a business owner seeking a better solution than the “sole proprietor” business model, then forming an LLC with a single member might be the right path for your future ventures. You still receive the benefit of being taxed as a sole proprietorship with the added benefits of liability protection.

What is an LLC with one member?

Business owners have an option to choose between various ways to legally structure their business entity. The type of entity they wish to form for their business depends on their existing status and the state they are in. LLCs or Limited Liability Companies are nationwide-accepted business structures where the owners are referred to as members.

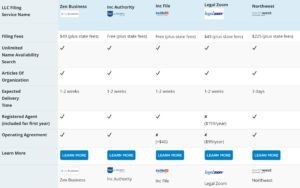

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

LLC with one member, as aptly put, is an LLC with just one voting member – you. This means that you will not be personally responsible to pay off debts and federal tax obligations that are imposed on the LLC. Your personal assets such as bank accounts, house, savings etc. will not be seized. This covers liability risks such as lawsuits concerning the LLC’s debt, wrongdoing committed by the LLC’s employees or non-payment of outstanding federal taxes.

An LLC with one member can be a service-based business such as a massage therapist.

How is a single-member LLC different from a sole proprietorship?

Even though an LLC with one member is taxed as a sole proprietorship, the two are distinct. Unlike an LLC, the personal assets of a sole proprietorship owner are not protected in case of debt or outstanding federal tax.

Sole-proprietorships only have one taxation option, which is to file the sole proprietor business taxes along with personal taxes. As an LLC member, you can choose how you would like the LLC to be taxed. For example, if a single-member LLC wants to be considered a corporation, they can fill out Form 8832 for Entity Classification Election. Also, single-member LLCs can still bring on new members.

How is a single-member LLC taxed?

The IRS (Internal Revenue Service) considers SMLLCs (single-member LLCs) disregarded entities for federal taxation purposes. This means that the IRS considers the LLC and its member(s) legally separate entities but for income tax purposes, they are the same.

To explain further, the IRS requires disregarded entities to report profit and loss incurred by the businesses on the member’s tax returns. It is reflected in Form 1040 or 1040-SR Schedule C.

Is the LLC member an employee?

In simple words: no, SMLLC members are not considered employees of the LLC.

Single owners of an LLC are regarded as self-employed. This means that they have to pay self-employment taxes, which include Medicare and Social Security based on the LLC’s net income.

This essentially implies that a member of an SMLLC cannot “take a salary” and report payroll taxes for themselves. However, they will be required to pay payroll taxes to the IRS if they hire employees. This includes unemployment, Medicare and social security.

A single person service business such as an electrician can be set up as an LLC.

Does the member get a salary?

As explained above, active owners that partake in the daily activities and operations of their SMLLCs are not considered employees of the LLC.

So how does the owner of an LLC with one member get paid?

The answer is not too complicated. They simply take money from the LLC’s business account. Called a distribution or draw, this transaction will not be considered a paycheck. Payroll and other federal and state taxes will be withheld against it.

It is important to note that the member should report the owner’s draw in the cash flow statements as a draw from the equity or capital account. These statements are recorded either in an excel sheet, traditional ledgers, or an accounting software program such as SAP. Failure to do so may make the LLC liable for repercussions (more on this in the section piercing the corporate veil).

Does an LLC member have to contribute to a retirement savings plan?

Setting up a retirement savings plan can be a little confusing for first-time business owners. For SMLLCs, there are typically two needs when it comes to retirement plans; the first is a personal plan and the second is one they need to set up for the LLC’s employees.

For SMLLCs, a Simplified Employee Pension Individual Retirement Arrangement (SEP-IRA) or a Solo 401(k) plan are two of the most effective options. The latter of the two is a viable retirement plan option for SMLLCs with no other employees while the SEP-IRA can be used by SMLLCs with other employees, which the member will pay into.

You can learn more about retirement plans on the IRS website.

What about liability with SMLLCs?

A Single Member Limited Liability Company protects business owners from corporate, legal, tax and other liabilities. This is called the Corporate Veil as it veils the LLC member from the liabilities that would otherwise be paid to a creditor in the event of a lawsuit.

For example, if an SMLLC has debt outstanding federal tax, the IRS will not seize the member’s personal property for repayment. However, there are some events that can lead to this veil being pierced.

Piercing the corporate veil

There are instances where a court may rule the limited liability the LLC enjoys as null and void. This means that in this case, your personal assets can be put on the line to pay off the said liability.

Fortunately, such incidents do not happen frequently. Extreme situations where the member is found guilty of fraud or another related crime can lead the court to pierce the corporate veil.

Forming an LLC with one member

LLCs are registered with the state. Besides minor exceptions, the requirements for forming a single member LLC are pretty much standard across all 50 states. The process can be simplified into the following steps:

- Registering the LLC’s name.

- Applying for an employer identification number (EIN).

- Choosing a registered agent for tax correspondence.

- Filing Articles of Organization documents with the Secretary of the State.

- Opening a bank account under the LLC’s name.

From there, the LLC must abide by the state and IRS’s requirements for lawful operations.

Closing thoughts

Forming an LLC with one member (single member LLC) is a commonly sought business structure. Despite the benefits it offers the business owner, there are some limitations that need consideration prior to filing the documents. These include the costs of forming and maintaining the LLC, keeping separate records, taxation of profits, etc.

Pros and cons should be weighed and compared with other business structures such as sole proprietorship, partnership, S or C Corp etc., which include pondering situations where the business might come under liability. Having an expert consultant opine on the subject with specific applications for your business will clarify whether an SMLLC is a viable option for you as the owner. For more general advice, subject matter experts can weigh in.