Many construction businesses start out small, either as sole-proprietorships or partnerships. That is, they don’t register their company with the state before taking on construction jobs. Many licensed contractors that are already in the construction business are considered sole proprietors (or partners). Starting a construction business as a sole proprietor (or a partnership) also doesn’t any special paperwork, or separate tax filings, as both sole proprietors and partners file their business income with their personal tax returns. So why should construction businesses bother incorporating? This is the question we need to answer before discussing different legal structures for construction companies.

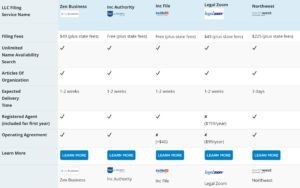

Compare The Best LLC Formation Services

Why Should A Construction Business Get Incorporated?

One of the core benefits of being incorporated regardless of the legal structure (LLC, S or C Corp) is that it separates the business from its owner(s). The business becomes an entity that is responsible for its own financial and legal obligations. If anything bad happens to the business such as if it’s sued or defaults on its business loans, only the funds and assets held by the business will be under fire. The owner’s personal property and assets will not be pursued to pay off the business’s obligations.

This is very beneficial for construction businesses because they have one of the highest debt ratios in comparison to other businesses. Construction companies need to buy costly materials and equipment, usually on credit. And if the project they are working on doesn’t go as planned, they still need to pay their creditors. If the construction business is not incorporated, the owner’s personal assets such as houses, cars and financial investments can be confiscated to pay off the financial obligation of the business.

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

Some construction companies run many jobs that have a high risk of injury. They also need to hire part-time contractors and labour. If a part-time contractor working under a construction company (that is not incorporated) gets injured and sues the company, the owner(s) or members can be held personally liable for the injury. Being incorporated can save the owner or members from the legal implications of such incidents.

An LLC vs. S Corp Construction Company: What would be the better fit for a small construction business?

If the owner of a construction company decides to incorporate, which is the best legal structure? The liability benefit is the same for both an S Corp and an LLC.

Let’s take a look at some other factors that can help you figure out which legal entity will be best for your construction business.

S-Corp vs. LLC tax implications

First of all, it’s important to understand that there is no separate taxation model for LLCs. If no specific tax category is specified, an LLC is usually taxed based on its number of members. A single-member LLC is taxed as a sole proprietorship, whereas a multi-member LLC is taxed as a partnership. Both are pass-through entities where the tax obligation of the business falls on the shoulders of the owner or members of a partnership. In this case, the owners and members also have to pay a self-employment tax.

An S Corp is also a pass-through entity like the single-member and multi-member LLC. But the shareholders of an S Corp receive the profits from a business in two ways: A reasonable salary and distributions (dividends). Shareholders only have to pay self-employment tax on the salary, and not on the distributions. This results in a significant tax break.

An LLC can choose to be taxed as an S-Corp, and get the same tax benefits that an S-Corp gets. If an LLC chooses to be taxed as an S-Corp, the tax benefit debate between the two entities becomes moot.

S-Corp vs. LLC: Ownership, Operations, and Management

Choosing the right business structure for a construction company might boil down to three factors:

- Ownership

- Operations

- Management

Understanding how an S-Corp differs from an LLC in these three aspects may help you decide which structure is best for your construction company.

Ownership

LLCs offer a lot of choices and flexibility when it comes to ownership structures. An LLC can have an unlimited number of owners (called members), and they can be non-US citizens as well. Also, an LLC can be owned by a different corporate entity, like another LLC or a C/S Corp. Whereas only 100 or fewer principle shareholders can own an S Corp, and they have to be US citizens. In summary, a construction company will have much more flexibility if incorporated as an LLC as opposed to an S/C Corp.

A Real-World Example

Let’s say that a small construction LLC wants to open a subsidiary for materials. Another LLC can easily be created under the parent LLC. But an S Corp construction company cannot easily open another S Corp subsidiary. It can, however, create an LLC. But there is an exception allowed.

An S-Corp can create a subsidiary S-Corp, by filing form 8669. In comparison, this structure has relatively stricter regulations and is very closely monitored by the IRS.

Operations

Business operations are much simpler for an LLC than they are for an S Corp. The business operations of an S Corp need to be a lot more “formal.” If a construction company is structured as an S Corp, it has to establish and adopt a set of bylaws. They may include the requirements for shareholder meetings, voting rights, the board of directors, management rights and responsibilities and record keeping. Most states require S-Corps to conduct shareholder meetings initially and on an annual basis, even if there are only a few shareholders. An S-Corp is also required to record and retain meeting minutes of the shareholders’ meetings.

In contrast, a construction company incorporated as an LLC doesn’t need bylaws. It only needs to adopt an LLC operating agreement, which is relatively simple to draft and in most cases does not need to be filed with the state. Like an LLC, a construction company can operate with much more flexibility. For example, Members of a construction LLC don’t need to have formal meetings or maintain records of those meetings. As an S Corp, the company may have to navigate through a lot of internal red tape and sometimes state-mandated regulations to make any major changes in their operational procedures, whereas an LLC can make these changes much more easily.

Management

Management of an S Corp has a rigid hierarchy. It needs to be divided into a board of directors and corporate officers. It makes sense in a large company, but can be cumbersome if the construction company only has a few members. Whereas in a construction LLC, it’s very easy to divide the roles and responsibilities of different members. In contrast to the S-Corp, no hierarchy is needed. Differentiating between the roles, and consequently, the profits of passive and active members are also easier under an LLC structure.

Ease of Formation and Cost

Forming an LLC is much more straightforward than forming an S Corp. You can even form an LLC online. It’s also significantly cheaper. On the other hand, creating an S Corp can be expensive, and time-consuming because of the added complexity. An S-Corp incurs more accounting costs in comparison to an LLC.

Final Words

The liability protection that a construction company may need is available in both the LLC and S-Corp structure. Through the right election (choosing S Corp taxation model), an LLC can enjoy the same tax benefits as an S Corp. So the choice may boil down to the structural and operational flexibility. Small and agile construction companies may benefit more from an LLC model. Some larger construction companies may function better under a more hierarchical S-Corp management structure.

Compare The Best LLC Formation Services