Rental properties are an amazing source of income. Unlike other businesses or 9-5 jobs, you don’t need to work on a fixed schedule while managing a rental property. As an individual, or a couple managing a few rental properties, your responsibilities include maintaining the properties, collecting rent, and finding tenants for vacant properties. You might wonder, if it’s not a full-time business, why would you need to incorporate?

Husband and Wife LLC for Rental Property

Many married couples choose to put their savings to work and use them to create a passive income stream. Some look for options like stocks, while others buy real estate. Real estate makes for an amazing investment, as it allows you to earn an income while you wait for the property to appreciate in value, after which you can sell it for capital gain.

However, owning a rental property on your own is very different from owning a rental property with your spouse. This isn’t only limited to the rental property business. Co-owning any business with your spouse is different from owning it as a sole-proprietor. You now each have a stake in the business and need to establish how much each one owns.

A Husband and Wife in Business

Each person in a married couple that forms a business has one of two default roles. The business relationship can either be an employer-employee relationship or a partnership. The IRS sees businesses where one of the spouses controls and manages the business, while the other provides services, as an employer-employee arrangement. In this scenario, taxation will be different from a husband-wife partnership.

A husband and wife that are in business together, and have an equal stake in the business, will be considered partners in a partnership. They will pay their taxes like any other partnership: Form 1065 for the partnership return, individual schedule K-1 forms for both husband and wife, and individual schedule Es forms (if applicable), with their individual tax returns.

Husband and Wife Partnership LLC

Spouses that are in business together have the option of incorporating as an LLC. A husband and wife LLC for rental property will benefit from the legal and financial liability protection that the LLC structure provides. If the LLC doesn’t elect for a separate taxation status it will be taxed as a partnership. In this scenario, the rental property’s returns and expenses must be filed by using form 1065, and then filing separate schedule K-1 forms. The other option is to form a corporate taxation status.

However, a husband and wife partnership has another option: a qualified joint venture.

Married Couple LLC and Qualified Joint Venture

A married couple that do not incorporate, but own a rental property together as a partnership can elect for qualified joint venture status. This allows a married couple to be considered as “one” entity for taxation purposes. The IRS disregards the “partnership” status of the married couple for taxation purposes, and the spouses can simply file one tax return instead of two. This also allows both partners to enjoy the credit for social security and Medicare coverage purposes, even though the returns are filed under one spouse’s name.

A husband and wife partnership is eligible for the qualified joint venture status if:

- Apart from the married couple, no one else is in the business.

- Both participate materially in the business. In case of a rental property, that would include both spouses having a financial stake in the business.

- Both spouses elect not to be treated as a partnership any longer.

- The business is owned and operated by the married couple, and it is not an LLC. In other words, it is a pure partnership and not an LLP or an LLC.

The last condition technically prevents husband and wife LLCs from applying for a qualified joint venture status, but there is an exception: if the husband and wife LLC is established in a community property state, it can apply to be treated as a qualified joint venture. However, if an LLC is formed in a non-community property state, it cannot and will not be considered a qualified joint venture. The LLC will be taxed as a normal partnership unless the couple elects for an S-Corp taxation status.

Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin are community property states, which means that if you have a husband and wife LLC in any of these states, you can make the Qualified Joint Venture Election. To do so, you will have to distribute the returns, profits, losses, credit, and deductions for you and your spouse in the jointly filed 1040. Since it is no longer a partnership, you won’t have to file separate schedule K-1s as well. Instead, you will file a single schedule C, and you may also need to file separate schedule-Es forms.

Making the qualified joint venture election will save you time in separate filing and record keeping, save you money on accounting costs, and will allow both of you to receive social security and Medicare benefits. This is all achieved while still filing a joint tax return. These benefits are much more significant as compared to what the conventional rental property partnership tax return offers.

If you don’t live in one of the US states that allow for community property, you have a choice. If you and your spouse own a rental property together, you can elect for a qualified joint venture status without forming an LLC. That status will give you the tax benefits, and ease of separate filing, but won’t give you legal and financial separation from your property. In order to do that, you may have to get landlord liability insurance.

Even if you aren’t eligible for a qualified joint venture, you may want to incorporate your rental property as an LLC.

Forming an LLC For Your Rental Property

Do you really need to form an LLC for your rental property? The answer is neither an absolute yes, nor a resounding no, instead it exists somewhere in between.

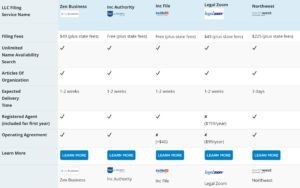

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

The case for not forming an LLC for your Rental Property

While there are a number of benefits of forming an LLC, most of them don’t apply to a rental property business owned by a married couple. Forming an LLC for a business offers it more credibility and corporate weight, as it gives you easier access to a business loan, a business bank account and an EIN number. This allows an LLC business to attract better clients.

But in the case of rental property (or a few rental properties), forming an LLC doesn’t make a lot of difference in this regard. Your current and prospective tenants only care about the rent, and that you are prompt with repairs and maintenance. Whether the property is under your name or XYZ LLC doesn’t matter to them. In fact, some tenants might prefer renting directly from a married couple rather than an LLC.

Property Title Changes

Another problem is the process of forming an LLC for a rental property. In most other small businesses, you have a comprehensive mix of assets and services. But in a rental property, your asset is the business. When you form an LLC for a rental property, you have to change the title of the property, and it is moved from under your name to your LLCs name. This is not a very difficult process unless your property is still under the mortgage.

A property that is under mortgage cannot simply be transferred under an LLCs name without the permission of your lender. Until you pay off a property completely, the lender has a stake in the property, which will prevent you from transferring the title of the property to another entity. This is why you will have to discuss your options with your lender. If the property is mostly paid off, your lender may allow you to transfer the property under certain conditions. If a lot of mortgage payments are left, your lender might be willing to let you transfer the title of your property to your LLC, after renegotiating the mortgage.

Benefits of Forming an LLC for your Rental Property

The biggest benefit of forming an LLC for your rental property is the same as any other business: legal and financial separation and liability protection. Property owners can get sued for all sorts of things: injury due to a flaw in the property, unjustly withholding the security deposit, owner entering the property without informing the tenant, etc. Any of these lawsuits could transform into a financial disaster for you. Landowner liability insurance is designed to counter these lawsuits, but they have stringent conditions and compensation limitations. You can get umbrella insurance to cover what your regular insurance won’t, but even that has limitations.

On the other hand, if your rental property business is incorporated as an LLC, and litigation occurs, the LLCs assets will be under fire, not yours or your spouse’s. This is why most real estate investors create separate LLCs for all their rental properties. If you have one LLC managing a few rental properties, a lawsuit against one of the properties can rope in all of the properties that are held in the name of the LLC.

Forming an LLC for a rental property and transferring the title of the property to the LLC (bringing the property under the LLC’s name) might be difficult. But if you create an LLC before buying a property, you can easily apply for a mortgage loan.

If you form an LLC to hold your rental property, you and your spouse will benefit from the pass-through taxation. This means that you can get the “property depreciation” deduction. It can be a huge benefit, as it can place you and your spouse in a lower tax bracket. The depreciation is only applicable for the building and everything within, not the land.

Example Of A Property Depreciation Tax Benefit

Let’s say you bought a $500,000 property with 20% ($100,000) down payment. The land is priced at $200,000, so the total amount that can be depreciated is reduced to $300,000. The usual depreciation (or general depreciation) system allows you to depreciate the entire amount in 27.5 years. For a $300,000 property value (minus the land), you can deduct over $10,000 every year in taxes. If the property earns you about $12,000 a year after expenses, the $10,000 depreciation write-off will reduce the taxable amount to $2,000.

Depreciation is one of the most significant benefits of real estate investments. A better way to use depreciation is seen in commercial properties and multi family investments. Through a cost segregation study, the depreciation time is shortened from 27.5 years, to 15, 7 or 5 years. Since depreciation is spread out over a shorter period, the tax amount you can write-off as paper loss increases considerably.

The tax depreciation might be recaptured by the IRS when you sell the property for capital gains. This can mean a substantial tax bill unless you roll the profits into a 1031 exchange. That is, use the proceeds of the first sale to buy a similar rental property. This way, you can defer from paying the capital gain taxes on the first property.

Final Words

A rental property is a significant investment. However , you can divide the cost of investment with your spouse as a partner. Choosing the right business entity to run your rental property business as husband and wife can save you time, resources, and offer decent tax benefits. A normal partnership might seem like the easiest to maintain for a single rental property. Even then, forming an LLC can shield your personal assets, personal residence and other investment properties, in the event that one of your tenants files a lawsuit against you. If you are planning on owning and managing more than one rental property, forming LLCs will offer you legal and financial liability protection, while letting you enjoy the tax-benefit of owning a rental property. Thanks to its pass-through taxation model, the LLCs structure is the best legal structure for a married couple rental property business.