Starting and running your own business can be much more rewarding than working for someone else, but only if it’s done the right way. It requires hard work, self-reliance, discipline, creativity, and a lot of preparation. But if you are tenacious enough, you can grow a small side hustle or your freelancing into a thriving and dependable business.

And this is what most business owners focus on in the beginning.

But when a business gains momentum, and it’s earning decent profits, there is a choice that single-owner businesses need to make. And that’s whether to keep operating as a sole proprietorship or form an LLC. Understanding the difference between a sole-proprietorship and LLC and weighing the pros and cons of both will help you make the right decision.

LLC vs. Sole Proprietorship

Anything you are doing to earn money that is beside a proper day-job is considered a sole-proprietorship. It can be something as small as landscaping gardens in your neighbourhood, or fixing computers. If you are doing it for a fee, you are running a small business and acting as a sole proprietor, at least in the eyes of the IRS. You don’t have to be earning a certain amount to be considered the sole proprietor of your business. You also don’t have to fill out any forms or jump through any legal hoops to create or form a sole proprietorship. Whenever you start earning money from a business where you are the only owner, you become a sole proprietorship.

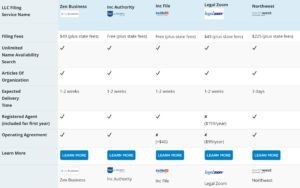

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

But an LLC is different. You have to create an LLC through a legal procedure. An LLC can be formed by a single person (usually called a single-member LLC or SMLLC), or multiple people. But since we are comparing it to a sole proprietorship, let’s limit ourselves to single-member LLCs.

There are many differences between the two entities, but the two major differences are legal separation and taxes.

Legal Separation

A sole proprietorship isn’t legally separate from its owner. If you are a sole proprietor, you and your business are a single entity in the eyes of the law. It doesn’t matter if your business account is separate from your personal account, or if your business office is miles away from your home. If your business has any financial obligations (payments to vendors), you are liable for them.

Similarly, if your business is part of a lawsuit, so are you. And you will be penalized as the sole proprietorship. There is a costly solution to that problem: business liability insurance, but it has its limitations.

An LLC, on the other hand, is legally separate from its owner. The business itself is a separate legal entity, liable for its own actions and obligations. If there is a lawsuit against the LLC, the assets and funds associated with the corporation will be under fire. But your personal assets will be safe.

This legal separation between the business and its owners is one of the primary reasons why sole proprietors choose to create LLCs.

Tax

Ironically, the IRS doesn’t recognize an LLC as a separate tax entity. While the law might treat an LLC and its owner separately, the IRS treats them as the one. An LLC is, by default, a pass-through taxation entity. Where the responsibility of paying taxes is passed through to the owner (or partners in case of multi-member LLC)

As a sole proprietor, you will have to file any profits you get from the business, alongside your personal taxes. The only difference will be an additional “self-employment” tax that will be levied on you. Currently, the self-employment tax rate is 15.3%. This is in addition to your personal tax liability, which is based on the tax bracket you are in.

If you form a single-member LLC, without electing for a separate tax identity (as an S-Corporation or a C-Corporation), you will be taxed like a sole-proprietorship. So if you are keeping the default taxation status of a single-member LLC, there is no tax difference between an LLC and a sole proprietorship.

When an LLC chooses to be taxed as an S-Corporation, it must follow a different set of taxation rules. A single-member LLC can also become a C-Corporation, but that rarely happens. An S-Corp is also a pass-through tax entity. But in an S-Corp, the owner wears two hats: The owner and the employee of a business. This allows an S-Corp to divide the profits into two parts. The first part is a reasonable salary that the owner receives as an employee of the business. The second part is the left-over profits as distributions. And while the salary is subject to the 15.3% self-employment tax, the distributions are not.

An Example

Let’s say your business earns you $80,000 in profit (after deducting expenses) per year. Filing singly, you will fall under the 22% federal tax bracket. You will pay about $10,775, just in federal tax. Till this point, there isn’t an effective difference between paying tax as a sole proprietor or an S-Corp LLC.

As a sole proprietorship, you will pay an additional $12,240 in self-employment tax, bringing your total tax bill to $23,015.

As an S-Corp LLC, let’s say you are receiving $40,000 in a reasonable salary and $40,000 in distributions (a 50/50 split). In this case, you will only pay a sum of $6,120 as your self-employment tax. This totals up to $16,895 in taxes. And it’s a flat out $6,000 tax break.

Pros and Cons of Becoming an LLC

In our opinion, the pros of becoming an LLC far outweigh the cons, but it’s still a good idea to evaluate them from your business’s perspective.

Pros

- Legal separation from your business protects your personal assets in case the business defaults on its payments.

- It protects you from the lawsuits filed against your business.

- As an LLC, you can benefit from the pass-through taxation model of an S-Corp, which significantly reduces your tax bills.

- More chances of growing your business. Under an LLC model, it’s easier to bring in limited liability partners. Also, being incorporated gives your business more professional weight and credibility.

Cons

- Forming an LLC has its costs. It includes the state cost, which falls somewhere between $40 and $500, depending on the state you are in. Also, the publication and name reservations fees.

- The running cost of an LLC can also be a bit more than a sole proprietorship. Based on the state you are operating in, you may be liable for a franchise tax, commercial activity tax, or an annual filing fee. Additional costs include bringing in a certified public accountant and additional administrative costs.

- An LLC will require more of your time for paperwork, and you will have to be much more careful about recording and keeping track of business transactions.

Conclusion

Even with the obvious tax benefits, not every single-owner business should convert to an LLC. For your business, there will be a break-even point where the tax break you get by becoming an S-Corp LLC, will be significantly more than the additional costs it incurs. So before your profits reach that level, it makes more sense (from a monetary perspective) to keep operating as a single-member LLC. Beyond that point, it’s better to form an S-Corp LLC.

From a liability perspective, transforming your sole-proprietorship into an LLC is always the smart option. But that also depends upon the type of and scale of your business. Also, thanks to websites like Zen Business, becoming an LLC is no longer a lengthy and complicated process. They offer a “turnkey” LLC formation service which is a huge time-saver. And, by getting help from Zen Business to help form your LLC, you’re less likely to miss important dates for filing and renewing your LLC with the state. The Zen Business Registered Agent Service, which is included in your first year of LLC formations service is there to make sure you stay on top of yearly filings and renewals.