So you have a business that you want to turn into an LLC (limited liability company). In other words, you’re wondering how to LLC your current business or a business you want to create. Somewhere along the way, you heard that this was the right thing to do to limit the liability you may face in the event of a lawsuit and for taxation purposes.

There are many ways you can register your business in the United States. These include:

A Partnership:

- General Partnership,

- LP Limited Partnership,

- LLP Limited Liability Partnership,

- LLLP Limited Liability Limited Partnership

An LLC

- LLC, LC, Ltd, Co (designation depending on the state) Limited Liability Company

- PLLC Professional Limited Liability Company

A Corporation:

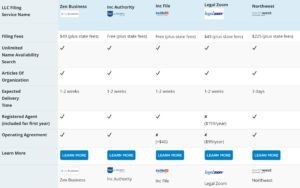

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

- Corp, Inc Corporation, Incorporated

- PC or P.C. Professional Corporation

- Doing Business As

You may have also heard that an LLC is the way to go. But what exactly are the benefits of having an LLC instead of other entities?

Advantages of an LLC

- Choice of tax regime: An LLC has several options for taxation. It can be taxed as a sole proprietor, a partnership, an S corporation, or a C corporation. This provides great flexibility, providing that the LLC qualifies for the type of taxation.

- It can be taxed as a partnership whereby the allocation of income, gain, loss, deduction, or credit can be different from the ownership percentage of each member.

- The owners of the LLC ( referred to as members) are shielded from some or all liability from acts or debts. The amount of liability depends on state shield laws.

- An LLC can have an unlimited number of members with no citizenship restrictions. In comparison, an S-Corp’s stockholders must all be US tax residents.

- Less record keeping and administrative paperwork than a corporation.

- Pass-through taxation. No double taxation unless the LLC elects to be taxed as a C corporation.

- With the default LLC taxation, you are personally taxed at the member level, not the LLC level.

- In most states, LLCs are treated as separate entities from their members.

- Ease of registration: in most states, a single natural person can set up an LLC.

- A separate LLC can own each property for real estate businesses, thus shielding the owner from cross-liability.

- Flexible membership options: Members of the LLC may be natural individuals, partnerships, trusts, estates, and other business organizations. The number of members is unlimited, regardless of the type of business entity.

How to convert your business to an LLC in 5 steps

At the end of this article, I’ll tell you about a service that enables you to form your LLC in a single step, which could save you a lot of time you could devote to growing your business. Yes, all you have to pay is the state filing fees, which you would normally pay if you did all the steps yourself.

Step 1: Choose The State

For most businesses, where you live, and conduct business is the best place to form your LLC.

Don’t be lured into thinking that forming a Delaware LLC will save you money during taxation etc., as the added cost and complexity might not be worth it.

For one, you must have a dual registered agent if you conduct business outside Delaware. In litigation, things can get very complex and pricey, so if this is your first LLC filing, choose the state you live in and do business in to file your LLC. In short, the extra fees and paperwork needed to form an out-of-state LLC is rarely worth the trouble.

For online or brick-and-mortar businesses (store, office, service center), you will only have to file one LLC for the state in which you do business.

If you plan to do business in several states, you must form an LLC for each state.

Step 2: Choose A Name For Your LLC

Requirements for names vary from state to state, but for the most part, the name of your business entity should be unique in the state where you are forming your LLC.

You may be restricted from using certain words in your business name, i.e., bank, insurer, trust, trustee. Additionally, the entity’s name cannot be deceptively similar to another business name, i.e., Westside Kitchen and Bath and Westside Kitchen & Bath.

You will need to append the abbreviation LLC to the end of your business name.

The Secretary of State’s website for your particular state will have naming requirements and information and a registry of existing business names. You can use this registry to determine whether or not the name you have chosen for your business is available.

Most states will allow you to reserve a name for a fee if you are not ready to form your LLC.

Step 3: Choose A Registered Agent

Most states require that you have a registered agent. You can nominate yourself, a specialized service, or a professional that meets the state criteria to be your registered agent.

A registered agent accepts legal and tax documents on your behalf. The registered agent is a point of contact between you and the state.

If your registered agent is a specialized service or a professional, you add a layer of anonymity to your business. In this case, your name and address are not revealed, and all communications with the state or others go to your registered agent.

In short, a registered agent is responsible for receiving and informing you of tax forms, legal documents, annual reports, and summons (notice of a lawsuit).

The registered agent must be a resident of the state where you form your LLC.

Step 4: Prepare An Operating Agreement for your LLC

This document will describe how the profits and losses will be divided amongst the members and each member’s contributions to the business. The operating agreement outlines how the business will be managed.

The operating agreement describes what will happen if a new member arrives or an existing member decides to leave. Some states require you to dissolve the LLC if no operating agreement was made before the movement of an LLC’s members.

The operating agreement isn’t filed with the state but is kept with your important business records.

Step 5: File The LLC Articles Of Organization With The State

The articles of organization is a document that offers details about what the entity represents. In some states, this document is referred to as the Certificate of Formation or the Certificate of Organization. You will file this document with the state to create your LLC.

Your State Secretary’s website will have a downloadable form for the articles of organization. The form varies from state to state.

In general, you will have to provide the following information in the articles of organization:

- The name of your LLC.

- The duration that your LLC will be active in the case that it will not exist perpetually.

- The general purpose for which your LLC was formed.

- Your registered agent’s name and address.

- Whether your LLC will be member-managed or manager-managed.

Each state requires you to pay a fee to file your articles of organization. You may be able to file the articles of organization online with your state’s business filing agency.

The processing time can vary from a few days to a few weeks, and you will receive a certificate by mail once the LLC has been officially formed.

Optional Steps

Step 6: Apply for an EIN

EIN stands for “employer identification number.” It is sometimes also referred to as a “business tax ID.”

An EIN is like a social security number for your business. Although you may get by with not having an EIN as a single-member LLC, having an EIN will facilitate many operations you may want to undertake in the future.

If your business qualifies for an EIN, you can apply to get one for free on the IRS’s website. If you take this route to obtain your EIN, ensure you are on the IRS’s official website by verifying that the domain is irs.gov.

Here are a few reasons why you should obtain an EIN while in the LLC filing process, even if it is for future actions. When it’s time to take those actions in your business, you will have one less obstacle to surmount to move forward.

- Opening a bank account: although you may be able to open a business account as a single-member LLC without an EIN, it may be more difficult. Most banks require an EIN to open a business account.

- Applying for a business loan: although it’s not always required, having an EIN can speed things along when applying for business financing.

- An EIN helps protect your identity: as a single-member LLC, you may be required to provide your social insurance number instead of an EIN for identification and registration purposes when you apply for business credit cards, loans, or web services. The more you share your SSN around, the higher the likelihood of it being stolen.

- Legitimizes and adds credibility to your business: An EIN is not essential, but it does streamline certain business operations. An EIN enables you to legitimately hire contractors or employees, which can help grow your business tremendously. Additionally, if you are a service-based business, you will become a more credible organization if you have an EIN on a Form W9. This form can be used by companies you do business with to report income paid to you, real estate transactions, mortgage interest that you have paid, and more.

Considering how easy it is to set up an EIN, there are a few reasons not to get one while setting up your LLC. An EIN is free to obtain from the IRS, and having one on hand may facilitate certain business activities in the future.

LLC formations services: weighing the options.

The steps outlined above aren’t too complicated for most and shouldn’t require outside help. There is, however, one detail that can be quite complicated if you happen to be a single-member LLC and want to maintain anonymity in your business. That is finding a registered agent.

You might be a solo entrepreneur that wants to focus on growing your business rather than handling business entity details. Plus, you might not know anyone that meets the criteria or is willing to act as a registered agent for your LLC.

You have two worthwhile options to consider if you are in this position.

Option #1: Get A Registered Agent Service ($119 per year)

In every state, business filing agencies require you to have a registered agent to act as a point of correspondence between your LLC and the state. The registered agent must be located in the same state where you have formed your LLC.

Here is a breakdown of the service your registered agent will provide for your LLC:

- Provides a physical address and acts as a point of contact between the secretary of state or other official government office and your LLC.

- Receive and process legal documents, notices, and documents on behalf of your LLC.

- Available during normal business hours.

- Able to promptly relay documents to concerned members of the LLC.

- Helps avoid missed deadlines, fines, and penalties for non-compliance.

So, you might think that the yearly fee is more than worth the stress relief the registered agent provides. Plus, your business’s costs for a registered agent are tax-deductible. As long as your LLC is profitable, you can declare the registered agent service as a business expense and get the registered agent service for “free.”

Get A Registered Agent From Zen Business

Option #2: Get A Full-Service LLC Formation That Includes A Registered Agent ($49 per year)

The easiest option is to get a full LLC formation package from a reputable company like Zen Business. The Zen Business starter pack for LLC formation is only $49, a small investment that could save you loads of time and headaches.

The Zen Business starter pack includes the following:

- Name availability search for your state.

- Articles of organization.

- Business filing & verification with your secretary of state.

- Registered Agent service.

- Operating Agreement & bylaws

- CPA assessment (financial recommendations for your business accounts)