Many freelancers, sole-proprietors, partnerships, and small family-run businesses choose to incorporate as an LLC. While there are several benefits of legally separating yourself from the business, is taxation one of them? Do LLCs pay taxes? Or does this financial responsibility fall to the owners and partners instead?

These are some of the questions we will try and answer in this article. And hopefully, clear some confusion around LLC taxation.

LLC Taxation

An LLC is taxed as one of four business entities. Three of these, sole proprietorship, partnership, and the S-corporation are “pass-through” entities. So, even if an LLC is legally “separate” from the owner(s), the tax responsibility passes through the LLC and to its owner(s). So for taxation purposes, the IRS sees the single-member (sole proprietorship) LLC, partnership (multi-member) LLC and the S-Corporation LLC and their owner(s) as one. A C-corporation (or just a corporation), is considered a separate tax entity, liable for its own taxes.

For tax purposes, an LLC is treated as one of four business entities by the IRS.

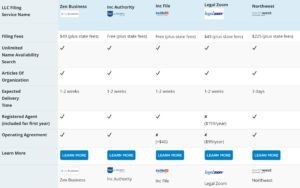

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

- Sole Proprietorship

- Partnership

- S-Corporation

- C-Corporation

If you don’t elect for specific tax status when creating an LLC, the default status is based on the number of members it has. A single-member LLC will, by default, be taxed as a sole proprietorship. A multi-member LLC will, by default, be taxed as a partnership.

1. Sole Proprietorship

A sole proprietorship is the default taxation model of a single-member LLC. But if they don’t make that choice, they are taxed as sole proprietorships by default. This means that the owner has to file the LLCs profits or losses for tax on a Schedule C form, along with the individual income tax return on Form 1040. It can be considered an LLC pass-through taxation process for a single-member LLC.

In this scenario, the IRS considers the LLC as a “disregarded entity.” The IRS disregards the single-member LLC and taxes the owner. This is the legal distinction between a single-member LLC and a sole proprietorship. In a sole proprietorship, the business isn’t separate from the owner. The owner is liable for all the debts and payments that the business has to make. And if a sole proprietorship defaults, the owner’s personal assets might be sold to clear the debts of the business. But in a single-member LLC, the business is legally separate from its owner. The creation of an LLC shields its owner from many financial and legal obligations of the business.

Owners of a single-member LLC also have to pay a self-employment tax, using a Schedule SE. And it’s important to note that even if you want to put aside any profits for future business expenses, you have to pay tax on them.

2. Partnership

A multi-member LLC is considered a partnership for tax purposes unless it opts to be taxed as a corporation. It qualifies for LLC pass-through taxation, and the responsibility of paying taxes transfers from the LLC to the individual members/partners. And the LLC’s individual members file them with their individual tax returns.

The profits or losses of a multi-member LLC or a pure partnership are divvied up based on the financial stake of partners in the LLC. If person A owns 75% of an LLC, and person B owns the rest, they will be eligible for the profits and losses based on that percentage. Consequently, they will pay taxes based on their stake in the company. So, person A might end up paying a lot more in taxes than person B.

Members of an LLC that want to divide the profits and losses from the LLC differently than their ownership percentage can use a provision called “special allocation”. It allows members of an LLC to divide profits and losses among themselves in proportions that are different from their financial stake in the company.

A similarity between being taxed as a partnership and a disregarded entity is the tax on business funds. Members may want to leave profits in the company account for growth or future expenses. In this case, each member will have to pay its due taxes, regardless of whether or not all the profits have been distributed to them.

Members have to file Form 1065 for a multi-member LLC that is taxed as a partnership. This is the tax form that includes total profits or losses of the LLC as a separate entity. But by itself, it’s not the tax return of the LLC.

The tax itself is filed by the individual members using a Schedule K-1 form. Each member’s schedule K-1 details the member’s total share and their corresponding profit (or loss) in relation to the LLC. They pay the LLC’s taxes on their own tax returns. The amount is based on their stake in the company. Form 1065 is to make sure that an LLCs taxes are filed and paid in full by reconciling it against individual schedule K-1s of the LLC members.

3. S-Corporation

A single or multi-member LLC can elect to be taxed as a corporation (C or S) by filing Form 8832. Not all LLCs can qualify to be taxed as an S or C-corporation. The LLC must meet certain conditions in order to qualify. For example, a C-corp LLC must be less than 100 members, have no preferred member class, etc.

An S-corporation is also a pass-through entity like a sole proprietorship or partnership. But its tax model is a bit different. In an S-corporation, the owner or partners are considered employees of the business. They are, therefore, eligible for a reasonable salary. There is no fixed calculation for deciding a “reasonable” salary. Still, a common practice is that members of a multi-member LLC are given 60% of their shares in the profit as salary and the other 40% as distributions. The same proportions apply for a single-member LLC that chooses to be taxed as an S-corporation.

The benefit of being taxed as an S-corporation is that owners or members of the LLC don’t pay self-employment tax on the amount they receive as distributions. This can save a lot of money in taxes, but being an S-corporation also brings in additional expenses like payroll tax returns and accounting fees, etc.

In order to be taxed as an S-corporationan LLC has to file Form 2553. The tax returns of an S-corporation are filed under form 1120S, and individual members have to file Schedule K-1 to go with Form 1120S. With their personal tax returns, they may need to file a Schedule E as well.

4. C-Corporation

In every scenario that we have covered so far, the LLC’s taxes are passed through to owners and partners. So when does an LLC have to pay separate tax? When the LLC operates as a C-Corporation.

If an LLC chooses to be taxed as a C-Corporation, the IRS treats the LLC as a separate tax entity. With this structure, the LLC itself becomes liable for its taxes. Tax returns are filed using Form 1120, and the profits and losses are not filed with the individual tax returns of the LLCs members.

The problem here is double taxation. As a separate tax entity, an LLC filing as a C-Corporation pays its taxes at the standard 21% rate. The profits are distributed to the members of the LLC as either dividends or salaries. And they are taxed again as individual income. Still, there are benefits of being taxed as a C-Corp, especially when your LLC grows beyond a certain level. And you have to leave a lot of your profits in the business for expenses and growth.

The profits you leave in the company are taxed as per the corporate tax rate. But if you leave profits in a pass-through taxation entity, they add to your income and push you in a higher tax bracket. And in a lot of cases, you end up paying more taxes on the profits, than you would have at the corporate tax rate.

Conclusion

As a single-member LLC, you can elect to be taxed as a disregarded entity, an S, or a C-corporation. Similarly, as a multi-member LLC, you can be a partnership, S, or C-corporation for tax purposes. You should thoroughly consider before opting for a tax status because it can have a significant impact on your bottom line. For most single-member LLCs, it’s better to stick with the sole proprietorship status. Choosing another tax structure requires that you thoroughly weigh the pros and cons. And analyze whether the tax benefits work out in favour of your particular business model. Also, once you choose to be taxed as a corporation, you can’t turn your status back to a sole-proprietorship or a partnership for five years.