Every knowledgeable person that has started to give professional advice and charged money for it has asked the question “should I form an LLC for consulting work?”

Consulting As A Business

Do you know what the five largest consulting firms in the world have in common? Answer: they are all named after their founders. PricewaterhouseCoopers (PwC), Deloitte, Ernst & Young, Klynveld Peat Marwick Goerdeler (KPMG) and Mckinsey are all named after their founders.

Why is this important? After all, many well-known businesses are named after their founders, i.e. Gillette and HP (Hewlett -Packard). But consulting is a little different in that it’s a service that is built around the expertise and experience of the consultants, and the professional advice they provide. A consultancy firm is not built around a physical product. One could argue that the consultant as an individual with specialized knowledge is at the core of the business.

The quality of personalized service that a consultant provides plays an important role in their success. For such “owner-centred” businesses, it may seem logical to operate as a sole-proprietorship, which doesn’t require any formal incorporation with the state. The sole proprietorship is the default business structure for most consultants who operate independently. But there is another business structure that is not much harder to set up and provides liability protection and passthrough taxation, just like a sole proprietorship: the LLC.

Before we weigh the pros and cons of the LLC as a corporate structure for consultants, let’s take a look at some terminology.

Terminology

Consultant, independent contractor, freelancer and “sole proprietor” are terms that are often used interchangeably. There is some common confusion about how they are different from each other.

A Consultant is an authority in a particular field of work or study that provides expert advice. This specific knowledge might relate to business, law, finance, HR, etc. In some cases, a consultant can provide services like IT support. Consultants may be employed by an organization, work independently or work as part of a consulting firm.

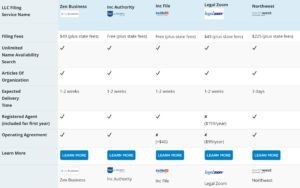

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

The IRS defines professionals such as doctors, dentists, auctioneers, and accountants as independent contractors. In their practice, they offer their services to the general public. It’s a relatively large umbrella.

Many people use the word independent contractor exclusively for professionals in the real estate business This is a wrong use of the term. There is a major difference between contractors and consultants. Consultants usually provide advice, help strategize and offer expert opinions. Contractors, on the other hand, offer their professional services. For example, an engineering consultant may help a company strategize on how to streamline its manufacturing process. An engineer working as an independent contractor may even provide the actual service to improve the manufacturing process in a factory.

A Freelancer provides services on their own terms. Many independent contractors are freelancers and vice versa. However, the terms are usually different in different industries. Similarly to freelance journalists, graphics designers and copywriters working on their own are mostly called freelancers. On the other hand, construction professionals, technicians, and electricians are usually considered independent contractors.

A sole-proprietorship is the legal business identity of any one-person business. That person may be a consultant, freelancer, or independent contractor. The IRS will treat them all as sole-proprietors regarding taxes. As sole proprietors, they will benefit from “pass-through” taxation, in which the taxes from the business pass through to their personal tax report. If there is more than one person in the business, it is considered to be a partnership, even if the partners are husband and wife.

Now let’s get to the main question.

Should I Form an LLC for Consulting Work?

The short answer is “yes”, but there are a few caveats. This guide will help you determine what is the best business structure for consultants: Sole-proprietorship and LLC.

LLC or Sole Proprietorship for Consulting

As a consultant, your options are not limited to operating as a sole proprietorship or incorporating as an LLC. You can form a C-Corp, an S-Corp, or start a partnership – but the LLC and the sole proprietorship are two of the most common legal entities chosen by small consulting businesses.

Main Differences Between A Sole Proprietorship And An LLC For Consulting

Liability

As a consultant, your material liability (physical assets, raw materials etc.) might be inconsequential. You usually don’t need a lot of assets and cash reserves in order to start a consultancy business. All you need is an office, a phone, and specialized knowledge to start offering consulting services. This is why few consultancy businesses seek financing options or look for lenders.

Consequently, you may think that you don’t need a lot of financial liability protection as a consultant. A consultant needs liability protection and legal separation from the business for a few important reasons.

Supposing that the advice you give during consultation results in personal injury or trauma, or one of your strategies causes financial losses to a business, you could face a lawsuit. The risk of facing a lawsuit is even more common for consultants who provide services. For example, if you fail to meet the client’s deadline or if the advice you provide doesn’t produce the promised result, you may get sued.

As a sole proprietor, professional liability insurance is available. Professional liability insurance also helps limit the possibility of counter lawsuits. Without professional liability insurance, your personal assets and valuables might be repossessed in order to pay for the damages.

The LLC (limited liability company) is an alternative to the sole-proprietor structure. While an LLC can face litigation, the legal separation it provides between you and your consulting business prevents personal assets from being seized in a lawsuit.

Taxation

Should I form an LLC for consulting work to save taxes? As a consultant operating as a sole-proprietor, or even as a partnership, you benefit from pass-through taxation. This means that the taxes owing from the business are passed through to you, the business owner(s). In a partnership, the responsibility to pay the taxes falls on the partners in the business. The amount of taxes each partner pays depends on the profits they receive. This amount is proportionate to their stake in the business.

An LLC is a pass-through tax entity. The IRS doesn’t identify it as a separate taxation entity, so when your business is incorporated as an LLC, you avoid double-taxation. An LLC’s default taxation status is determined by the number of members. Single-member LLCs are taxed as sole-proprietorships, and multi-member LLCs are taxed as partnerships. If you form a single-member LLC for your consulting business, it would be considered a “disregarded entity” for tax purposes. The IRS will “disregard” it and directly tax you as a sole-proprietor. In other words, your LLCs taxes “pass-through” to you.

LLC Tax Benefit

From a tax perspective, a single-member LLC and a sole-proprietorship are the same. So, what’s the difference? If tax is your sole measure of comparison, why choose one over another?

A sole-proprietorship cannot change its tax status without converting into a partnership, LLC, or an S/C-Corp. When you form an LLC, you can elect to be taxed as an S-Corp, or a C-Corp, instead of paying taxes based on your default “sole-proprietor” status.

In some cases, it is beneficial to incorporate as an LLC that is taxed as an S-Corp, because of the tax advantage that it may provide. As an LLC with S-Corp taxation, you are the owner, as well as the employee of the business. As an owner, you receive the profits of the company as distributions a.k.a dividends. As an employee, you get a “reasonable salary.” In the case of a sole-proprietorship, you have to pay an additional “self-employment” tax on all the profits of the business. But if you form an LLC and elect to be taxed as an S-Corp, you pay the self-employment tax only on money you receive as salary and not on money you receive as distributions.

The cost of forming an S-Corp LLC and maintaining its business structure might be more than the tax advantage you receive. In light of this, it might not be advantageous to incorporate as an LLC with s-corp taxation if your business isn’t making significant profit. The cost of maintaining an S-Corp LLC may include an annual fee, holding investor meetings, and keeping records of these meetings. You may also need to keep a record of any major company decisions depending on your state.

Credibility

A consultancy business that is incorporated as an LLC can benefit from the added credibility offered by the LLC corporate structure. Finding better paying consulting contracts may be easier as an LLC than as a sole-proprietor.

As a sole-proprietor, you will probably be working under your own name and receive payments in your personal bank account. This is usually fine for small clients, but many large organizations prefer to deal with established businesses rather than individuals. As a sole-proprietor consultant, you might be lumped together with independent contractors and freelancers. But as an LLC, you will be considered as a legitimate business, even if you form a single-member LLC.

Audit

Sole-proprietors file Schedule C to report income or loss from their business. “Under reporting” on Schedule C makes up a significant portion of the tax gap every year. This increases a sole-proprietorship’s audit probability. While this is not a benefit specific to the consultancy business, it is still an important factor to consider. As a consultant, your chances of being audited are relatively low. Incorporating your consulting business as an LLC can lower your chances of an audit even more. Compared to a sole-proprietorship, an LLC is a well-structured business, which keeps the business and personal expenses separate, thus significantly reducing the chances of underreporting.

Cost

A sole-proprietorship doesn’t incur any annual state filing costs. You don’t have to file any special paperwork to start operating as a sole-proprietor.

On the other hand, there are costs associated with LLC formation. You must pay state filing fees at the time of formation, and annual fees to maintain your LLC status. Your accountant may charge additional accounting fees that result from extra tax filings. Your accountant will have to handle your LLCs taxes in addition to your personal taxes when annual income tax reports are due. Your accountant may charge a premium for the extra workload.

Operational Flexibility and Growth

A sole proprietorship offers the highest degree of operational flexibility among all business structures. Since one person makes all the decisions in the sole-proprietorship, there is no need to wait for approvals. Any changes can be made quickly. The sole-proprietor has complete control and autonomy over day-to-day operations and how the business is run. This is perhaps the most beneficial aspect of a sole proprietorship and is what makes it so attractive to consultants.

Forming an LLC might seem more complicated than running a sole proprietorship, but required much less paperwork and maintenance than an S-corp. As an LLC, you don’t need to write bylaws, hold shareholder meetings, or develop a rigid hierarchy like you do if you incorporate your consulting business as an S-Corp.

If you plan to expand your consulting business, then forming an LLC might be the best option available to you. If you bring in people when you are operating as a sole proprietor, you will either have to classify them as employees or partners. If you are looking to incorporate your consulting business, there are two more business entity options worth considering.

Forming an S-Corp or a C-Corp for Consulting Work

“Incorporating” your consulting business isn’t limited to forming an LLC. Although rare, as a consultant you can form a C-Corp, or a single-member S-Corp. It is much easier to form an LLC and elect to have s-corp or c-corp taxation by filing the appropriate form and getting approval for it. The problem with forming an S-Corp is the red-tape and complexity of the process.

Forming an S-Corp is a two-step process. First, a corporation is formed (C-Corp) by registering with the state and filing articles of incorporation and other necessary paperwork. Next, the corporation has to make an S-Corp election, by filing Form 2553. The owner of an S-Corp has to be very careful about determining what is a reasonable salary for employees. The guidelines for what’s reasonable compensation are a bit unclear, but the IRS offers some insights.

S-corp Scrutiny From The IRS

The IRS holds corporations (S or C) to a much higher standard of scrutiny than LLCs, since the rules they are required to follow are more stringent, and their setup cost is relatively higher. Some large consulting firms choose the S-Corp structure, as it enables them to formalize their operations and management to a greater extent than the LLC structure.

An S-Corp has a board of directors that defines and direction and the long term goals of the company. The board of directors are identified in the S-Corp bylaws. Corporate officers (also called the management) handle day-to-day operations. Any significant change made the company’s management structure must be approved by the board of directors.

Consultancy firms and organizations very rarely incorporate as C-Corps. Those that do are large. As a C-corp, they sometimes bring in shareholders or issue stocks.

Final Words

You may be a firm believer that one of these structures (sole proprietorship, LLC, S-Corp) is better suited to a consultancy organization than another. There is no one size fits all corporate structure for consultants, but in most cases, the LLC provides all the necessary liability protection. By forming an LLC, you are legally and financially separate from your business. This is especially true if consultancy is your primary source of income.

As a full-time or part-time consultant, forming an LLC might seem like an enormous hassle. However, the investment is well worth the liability protection that an LLC offers to your consulting business.