Forming or incorporating an LLC requires careful consideration of various factors such as the type of LLC you want to form, who will make management decisions, what will be the structural hierarchy, what will each member’s share be etc. Among various regulatory and technical factors is choosing which is the best state to form an LLC.

Some businesses are location-dependent. In this case it is best to form an LLC in your home state. If you have a web-based business, you may want to consider forming a foreign LLC in a low-tax state like Delaware.

It is an observable fact that different industries thrive in different regions. The Silicon Valley in California, Wall Street in New York and French restaurants in New Orleans will do reasonably well, while a fancy French restaurant in the suburban Midwest will not attain the same attention as an all-American diner would.

Demographics, target audience, resources, nearby facilities etc. all have a resounding impact on the probability of success that a particular type of business is likely to have based on where they lay their foundations.

When it comes to forming or incorporating an LLC, the considerations are not so different. An entrepreneur with aspirations of success might wonder which is the best state to form an LLC in as it will have an impact on its success.

For many entrepreneurs, this aspect of LLC formation is confusing. There is a lack of general understanding of how LLCs work in the United States. In this article, we will cover the basics, potentially helping you make the right decision on the best state to form an LLC.

Best State to Form an LLC

Incorporating in Your Home State

If you were to line up CPAs from around the country, each would have a slightly different opinion on this subject. For the most part, however, the general consensus among the majority is that the best state to form an LLC in is their home state.

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

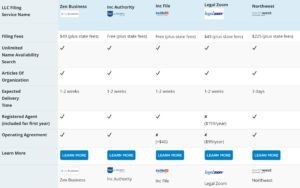

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

This particular direction makes a lot of sense as it is obvious. The state you have a home in will be the one where you run your business out of. This is one of the main reasons entrepreneurs take this route.

Besides the benefits of pass-through taxation and protection against liabilities, forming the LLC in your home state is convenient. As a result, business owners mostly most often form their LLC within their state of residence.

Conducting Business

Before taking the discussion further, it’s imperative to understand what we mean by conducting business. In the context of forming an LLC, this means that you run a business where you have either a facility or office space and/or have employees working there. If either is true, most states will require you to register the business in that very state.

Additionally, forming an LLC in your home state may be more cost-effective. As a resident, you may be able to save on filing costs at the time of forming the LLC and then later on with the annual fee that you must pay to the secretary of state.

Another benefit of filing in the state you conduct your business in is that you won’t require a paid registered agent to send and receive certain notices and legal documents from the state. However, many LLC owners still opt to have a registered agent so they don’t have to undertake the task themselves.

Registering an LLC out of state

If your business is not limited to a brick-and-mortar presence in your home state, then other states can be considered for LLC formation. Also, if you have a business that requires you to conduct most of your activity in other states, then forming a foreign LLC in that state might be a suitable option.

Online business

Online businesses have more options available to them. The same applies to businesses that are location independent, such as a consulting or web designing business. The IRS considers LLCs as disregarded entities, which means that for taxation purposes, the owner/s and the business itself are two different entities. This means that both can exist in two different states. The advantage of forming an LLC out of state would be for things like favourable tax and corporate laws, resources, talent and corporate infrastructures.

For such businesses, which is the best state to form an LLC in?

A few states are deemed favourable to foreign LLC formation. Before we discuss the advantages and disadvantages of forming an LLC in a jurisdiction other than the state that you reside in, we’re going to discuss the difference between domestic and foreign LLCs.

Domestic vs Foreign LLCs

A Foreign Limited Liability Company, in contrast to a regular LLC, is formed in another state in addition to its state of origin. The state is foreign for the business as it is an extension of the principal LLC but not separate.

For example, if a web development company is first founded in California, it will file as an LLC with California’s Secretary of the State. After earning sufficient success to become profitable, the company may decide to expand to a new state such as Massachusetts.

Once they have scouted a location for lease and found employees, they have to obtain licensure and form an LLC with Massachusetts’ Secretary of State in order to conduct business. This will allow the company to pay taxes and comply with state regulatory requirements.

In 49 out of 50 states in the U.S., businesses are required to register any out-of-state expansion of their LLC as a foreign LLC along with maintaining their domestic filing.

Overall, this means that LLCs are best formed in states where you will be conducting the majority of your business out of; and for many, this is their home state. If that’s not the case and you plan on incorporating your LLC in your home state while you conduct business in another, you will also have to set up a foreign LLC.

Which State is the Best for LLC Formation?

You might wonder which state holds the most benefits for your business. Let’s take a look at some factors that may influence your decision.

The first item for consideration is your business itself. As discussed earlier in the article, every business is unique and has different requirements, which often makes operations in particular regions unsuitable.

Some states may be more favourable to your industry and offer more business potential. The next thing to consider is the future of your business.

This also includes conducting preliminary market research in the state you are planning to incorporate in and determining whether there will be demand for your product or service. If the local market doesn’t respond well, you might end up incurring losses.

Additionally, you need to consider whether you will be able to find resources, especially skilled human resources. Local job market research will reveal whether forming an LLC in that state is a viable option.

Secondly, you want to consider the cost of forming and maintaining an LLC in another state.

These are all questions you need to ask yourself before making any kind of commitment.

Some other factors that may sway your decision include:

Legal Reasons

Some states have statutes that simplify the filing process and favours quick processing when it comes to legal interests of the company; e.g. the time is taken to rule a case.

State and Sales Taxes

All businesses, especially small businesses, aspire to pay as little in taxes as possible – whether they are state or federal. When filing an LLC, a state with low state taxes means that you will not only save on taxes but also reduce possible tax liabilities.

There are seven out of 50 states where there is no income tax. This includes Wyoming, Nevada, Florida, Texas, Washington, South Dakota and Alaska. In addition to these, New Hampshire and Tennessee levy taxes on dividends and interest income but not on wages.

When it comes to low tax states, Colorado, Alabama, Georgia, New York, Louisiana and Hawaii have the lowest rates. On the other hand, Hawaii, Alaska, Wisconsin, Wyoming and Maine have the lowest state and sales taxes combined.

Costs

This mainly includes costs involved in incorporating the LLC, obtaining licenses and paying annual LLC registration fees.

LLC-Friendly States

Wyoming, Nevada and Delaware come up frequently as the best state to form an LLC in.

Pros And Cons Of Low Tax States

Wyoming

Out of the three, Wyoming is considered the third most popular. It is considered the third most business-friendly state, which is interesting as this was the very first state to even recognize LLCs as legitimate business structures in 1977.

There are many business incentives that companies enjoy in Wyoming: the lack of corporate state income and franchise tax is the biggest advantage. Annual report filing fees are also low with businesses spending less than $100 annually. Sales taxes are as low as 4% with some exceptions.

Nevada

The main reason for choosing to form an LLC in Nevada is that there are no levied taxes on:

- Capital gains profits

- Business income

- Inheritance

Besides nominal annual and business license fees, the state doesn’t impose franchise tax, doesn’t mandate an operating agreement or annual meeting. Nevada is also disclosure-friendly, as it has a no information-sharing agreement with the IRS.

Delaware

Delaware claims the number one position on many lists as the most business-savvy state for forming LLCs. It has been so for numerous years and continues to hold its reputation as being an LLC-friendly jurisdiction.

In Delaware, there are no levied taxes on out-of-state income. Furthermore, initial filing fees and franchise taxes are low.

The Chancery Court in Delaware

The Chancery Court gives Delaware an advantage as an LLC-friendly state. This court is unique to Delaware. The Chancery Court undertakes business matters, which include disputes and other cases. Instead of waiting long terms in civil courts, LLCs, have their cases processed much faster.

Delaware For Online Business

Depending on your situation, Delaware may not be the best state to form an LLC for online business. If an online business owner is considering forming an LLC and chooses Delaware, a foreign LLC will be an option. In this scenario, income earned through the LLC in the home state will not be taxed. However, other taxes levied on LLCs in the state will be payable.

On the flip side, setting up a foreign LLC in Delaware may be more costly than simply forming an LLC in the state where the business owner lives.

Final Thoughts

While Delaware, Wyoming and Nevada reign as the top three choices among LLC owners, the best state to form an LLC depends on your business, future plans and the likelihood of success and profitability.

Generally, your home state offers the most convenience, especially if you’re catering to a local audience and you already have an established brand. Checking filing and annual reporting fees, tax rates, and doing market research concerning your product or service will help you determine whether or not it is advantageous to form an LLC in your home state or in a low-tax jurisdiction.