3.53 trillion dollars! That’s how much money people around the globe spent on online retail shopping in 2019. It’s a 164% increase since 2014, and analysts are expecting the number to go much higher in the coming years. Brick and mortar retail stores are steadily losing their share of the market, and online retail businesses are seeing ever-increasing activity. In 2019, e-commerce accounted for 14.1% of the total retail sales in the world, and it’s expected to increase significantly in the future.

If you are running an online retail business or thinking about starting one, you will have to decide if it is advantageous to incorporate it. You also have to figure out which is the best business structure for online retail.

Best Business Structure for Online Retail

In many cases, online retail businesses don’t start out online. Many brick and mortar store owners either completely convert their business to online retail or start an online retail business in conjunction with their existing business.

Some people do start a purely online retail business (e-commerce). In both scenarios (brick and mortar and e-commerce), these businesses begin as sole proprietorships.

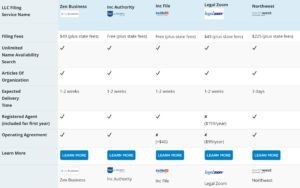

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

Many entrepreneurs start their first e-commerce business with Amazon, the largest online retail platform in the world. The majority operate their businesses as sole proprietors. But is it really the best option? What are the alternatives?

The IRS recognizes five basic business structures:

- Sole Proprietorship

- Partnership

- Corporations

- S Corporations

- Limited Liability Company

Out of the five, we can discard the Corporation (or C Corporation) option. It’s more suited to large companies and organizations. As a start-up or a small online retail business owner, you might want to stick with the other four options.

Sole Proprietorship

This is the simplest, and still one of the most prevalent business structures among small online retail businesses. And the reason is simple. You don’t need to do anything special to start a sole-proprietorship. When you start your online retail business, whether it’s for selling used items online, your own hand-sewn scarves, or collectibles you find in auctions, you are considered a sole-proprietor by default. It allows you complete control over how you run your business.

Contrary to popular belief, you can have employees as a sole proprietor of an online retail business. For example, you can hire a full-time delivery driver to make deliveries for you. In order to do this, you have to register with the IRS as a sole-proprietor business and obtain an EIN (Employer Identification Number).

Taxation

As a sole proprietor, the profits from your business are filed as part of your personal income taxes. You also have to pay a self-employment tax by filing a schedule SE (form 1040).

Liability

There are a few cons to operating as a sole proprietor. As a sole proprietor, you and your business are the same, financially and legally. If you take out a loan to buy some products to sell online, the banks (or other lenders) will check your credit history. In the event that your sole-proprietorship gets sued, your personal assets are at risk. If someone gets hurt using one of your products and sue the business, it means they are suing you and your business. If the law finds you and your products responsible, you have to pay for the damages, even if you have to liquidate your personal assets.

Despite these potential problems, many online retail businesses keep operating under the sole-proprietorship structure.

Partnership

Partnerships are very similar to sole-proprietorships. They offer no legal and financial separation from the business. In e-commerce businesses, partnerships might be a relatively hard business structure to tackle, especially for taxation purposes. In a partnership, the default stake of partners in the business is dependent upon the capital they contributed to the business. So if Mr. A invested 60%, and Mrs. B invested 40%, they will be eligible for similar proportions of profits and losses. Therefore, the tax responsibility will be divided in the same ratio.

Let’s consider an example of a physical store converting into an online retail business. If the retail store owner partners up with an e-marketer to start an e-commerce business, they might distribute the profits from the e-commerce business 50/50. But that’s not proportionate to their financial stake in the business. In this case, the store owner is bringing the actual assets on the table, while the e-marketer is bringing their expertise and know-how of the digital landscape.

Therefore, if you want to change the ratio of the division of profits, and consequently, the tax responsibility, you have to inform the IRS. Consult the partnership basis guidelines provided by the IRS, especially if you want to change the profits and tax responsibility ratio that is different from the partners’ financial contribution to the business.

S-Corporation

The S corp structure is a very unusual choice for small online retail businesses. Unlike partnerships and sole-proprietorships, forming an S-corporation for your online e-commerce business does provide you with a “corporate veil.” As an S-corporation, your business will be a separate legal entity. If there is any problem with the products you sell online, customers can sue the business, but not you personally. As a corporation, you also have more credibility, and as a result, you can attract better lenders, financial partners, and investors. The best part about forming an S-Corp for your online retail business is that you don’t have to pay self-employment tax.

For taxation purposes, an S-Corp is also a pass-through entity like a sole-proprietorship or partnership. But even if the responsibility of paying taxes passes through to the owners (or partners), the tax distribution for S-Corp is a bit different. In an S-Corp, you receive profits from the business in two parts: distributions (dividends) and a reasonable salary. You only have to pay self-employment tax on the profits you receive as the salary. This can result in a decent tax break. But you have to weigh it against the cost of forming and running an S-Corporation.

On the flip side, an S-Corporation must follow much stricter regulations than a sole-proprietorship or a partnership. As an S-Corp, you have to conduct annual meetings, write by-laws, and keep a proper distinction between your personal and business assets. S-Corp business structure can quickly turn into an administrative nightmare if you are running an online retail business out of your garage.

Limited Liability Corporation

The most commonly used business structure (after sole proprietorship) for an online retail business is the LLC. Choosing an LLC as your e-commerce business structure gives you legal and financial separation from the business. Incorporating as an LLC for an online business is a common structure choice because it’s much more flexible than forming an S-Corporation or C-Corporation. And, it still provides the benefit of liability protection.

The LLC structure offers more growth opportunities to the business. As a sole proprietor or a partnership, a business doesn’t have the corporate credibility that many investors or lenders seek, which limits your financing options.

As an LLC, your online retail business can enjoy the best of both worlds: The operational and management flexibility of a sole-proprietorship, and the legal separation and liability protection of an S or C corporation.

It’s important to note that an LLC is not a separate tax entity. If you form a single person LLC, it will be taxed just like a sole-proprietorship. A multi-person LLC will be taxed as a partnership. But you can elect to be taxed as an S-Corporation. The S-Corp option can save you a decent bit of money, if you are a larger organization, since you will have to pay significantly less self-employment tax.

Final Words

Many small online retail business owners delay the incorporation of their business. This is understandable, since generally, getting their business off the ground is their first priority. Once the business gets some traction, then they think about formalizing or incorporating it. But, in many cases, the right business structure can become a catalyst for growth. Even if it doesn’t stimulate growth for the business, the liability protection offered by LLC or S Corp business structures can be a lifesaver for you and your assets.