Most small businesses start out as either a sole-proprietorship or a partnership. If you own such a business, one question you will eventually ask yourself is; at what point do I need an LLC? Many business owners don’t bother with that question at all, even if operating under their default business model is deterring their growth. On the other hand, some small business owners and entrepreneurs take a very proactive approach to choosing the right business model. If you are one of them, you may have looked for answers to questions like; “do I need an LLC to start a business?” Or “do I need an LLC to freelance?”

The answer is different for different businesses. It depends upon the nature of the business, its scale, growth prospects, taxation, management structure, and local regulations. But there are a few things that can help you identify the point when your business needs to become an LLC.

Legal Liability

If the nature of your business puts your personal assets at risk from creditors or legal lawsuits, you need to form an LLC. Many sole proprietorships such as freelance writing or being a virtual assistant might not run the risk of being sued by the clients and don’t need to take out loans because they are essentially service-based businesses. But if you run a catering business from home, a client may sue you for unsatisfactory services, or something more serious, like food poisoning.

This is an unlikely scenario, but it’s an example of how the legal liability protection of an LLC you can shield you from the legal repercussions of your business’s mistakes. If you lose a lawsuit as an LLC, only the cash reserves and assets that are held in the name of your LLC will be in danger. Your personal assets like your car, home, and equity will not be in the line of fire. But if you get sued as a sole proprietor, the law won’t distinguish between you and your business.

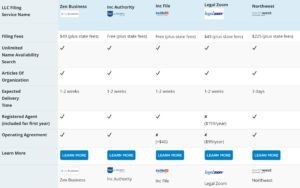

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

So when and if the nature (or scale) of your business demands it, you should form an LLC. In a partnership, becoming an LLC will also protect you from the actions and liabilities of other partners and employees of the business.

Cost-Benefit

Forming and running an LLC has its costs, like registration fees, annual LLC fees, operating agreement charges and accounting costs. But as an LLC, you also have the option to be taxed as an S-Corp (or a C-Corp), which can offer tax benefits. As an S-Corp LLC, you can divide the income from the business as reasonable pay and distributions. If you are operating as a partnership (filing taxes as an S-Corp LLC), you and the other partners will only have to pay a self-employment income tax (15.3%) on the income you receive as reasonable pay. Therefore, you and the other partners (if there are any) will save money on the taxes you receive as distributions.

Simply becoming an LLC doesn’t change your default taxation status. If you are operating a one-person business, you will be taxed as a sole-proprietorship. If there are two or more people in the business, it will be taxed as a partnership, whether or not you form an LLC. But if you are choosing the S-Corp taxation as an LLC, the right time to form an LLC is when the tax benefit outweighs the cost of forming and running an LLC. But it’s a choice and not a necessity.

Growth

In some cases, operating as sole-proprietorship or a partnership may be detrimental to the growth of your business. This may be especially true if you need to bring in investors or partners. An LLC has more business credibility. For a freelancer who provides their services as a sole-proprietorship, it might be hard to attract large-scale clients. But if the same freelancer forms an LLC, corporations and other large-scale clients are likely to take them more seriously. That’s because businesses feel more comfortable hiring the services of other businesses.

Becoming an LLC doesn’t take away the flexibility and ease of management offered by a sole-proprietorship or a partnership. It does, however, more clearly defines the management structure and roles of partners in a business, which can be very helpful in case the business dissolves or splits into two separate businesses.

Final Words

For many small businesses, it might never be compulsory to form an LLC. But based on the nature of your business, the legal separation an LLC provides you from your business can be highly beneficial. It can protect you and your assets from the financial and legal liabilities of your business. And beyond a certain scale, you might find it easier to grow your business as an LLC, compared to a sole-proprietorship or partnership. Incorporating as an LLC means that you are eligible for a business loan from a bank, and gives you a sense of legitimacy from the eyes of private investors. If you are running a successful and mature business, and wondering “at what point do I need an LLC?” you may want to leave your business entity formation up to professionals.

Compare all the best turnkey LLC formation services available. Some even get you started for free (+ state fees). When getting your business off the ground, you want to devote all of your time and energy to growing your business. With an LLC formation service, you can delegate the entire process to a formation service that will save you time, money and costly mistakes.