The United States is the land of opportunity and thus, recognizes the importance of self-sustenance and entrepreneurship. To facilitate business creation, the country’s federal and state statutes recognize various forms of business structures and entities. In addition to conventional legal structures such as the sole proprietorship, partnership and corporation, the LLC (Limited Liability Company) is also popular as an entity for small and medium-sized businesses.

As a state statute-recognized business entity, the LLC provides the benefit of limited liability protection to its owner/s. This is the same liability protection that is offered to large corporations.

But how does an LLC pay taxes at the

It is easy to file taxes for an LLC, as the taxes can be filed together with your personal tax return. The IRS doesn’t classify an LLC as a separate taxable entity and instead treats it as a pass-through entity. The profits and losses pass through to the member/s (owners).

How Does an LLC Pay Taxes?

In order to form an LLC, the owner (referred to as a “member” when talking about an LLC) submits an application to the Secretary of State along with an operating agreement.

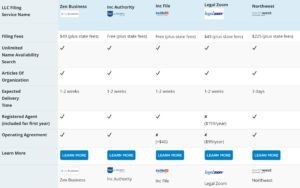

Take The Hassle Out Of Forming Your LLC. Compare The Best LLC Formation Services.

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

In terms of tax payment, the LLC structure is quite flexible. The IRS will treat the LLC company as a partnership, corporation, or as a disregarded entity depending on how the member chooses to be taxed (this is for LLCs with only one member or single-member LLCs).

When it comes to paying taxes, it all depends on how the owner/s’ designed the LLC.

Considering this, there are four ways an LLC will be taxed:

- As a sole proprietor if the LLC is a single-member LLC

- As a partnership, if the LLC has more than one member (multi-member)

- As a C-Corp if an LLC has filed IRS Form 8832

- As an S-Corp if the LLC has filed IRS Form 2553

A single or multi-member LLC is considered to be a pass-through entity. The profits and losses are passed on to the members who then declare the amounts on their personal tax returns (along with any other source of income). The tax payment to the IRS is done in the form of a self-employment tax i.e. Social Security and Medicare Tax.

Let’s take a deeper look into how exactly LLC taxation works for LLCs with different structures

Single-Member LLCs

Single-member LLCs are classified as sole proprietorships by the IRS. For example, if you are the sole owner of an LLC, you must report your income and expenses on your personal tax return form i.e. Form 1040.

In addition to Form 1040, the LLC member (owner) will have to report the profits, losses and tax returns on another IRS form called Schedule C using the business’s financial records and receipts (for deductions and expenses).

*Note: Depending on the type of business, the LLC owner may file Schedule F and/or Schedule E forms as well.

Furthermore, the owner will also have to pay and file Self-Employment taxes (Medicare and Social Security) using the Schedule SE Form.

The LLC enables the member-owner to file the business taxes along with their personal tax filing.

Multi-Member LLCs

How does an LLC pay taxes if it has more than one member?

Multi-member LLCs are classified as partnerships for tax purposes. When multiple owners set out to form an LLC, they have to declare the distributive share in the Operating Agreement. The distributive share represents the ownership percentage of each member.

For example, if Saul and Kim have a 60-40 stake in the LLC, Saul will be entitled to 60% of the profits and losses passed through to his income statement; while Kim is entitled to 40%.

Typically, the distributive share and percentage interest are equally proportionate. This means that the owners will be liable to pay taxes on their share of the profits on their individual tax returns.

LLCs are required to report their earnings or losses through Form 1065 and Schedule K-1. The former requires the LLC’s balance sheet, deductible expense information and year-end financial statements.

Schedule K-1 forms are provided to each LLC member, on which they fill in the details of their share of profit and loss. These profits and losses are then reported on the members’ Form 1040 tax returns and Schedule E.

How Does an LLC Pay Taxes as a Corporation?

C-Corp

Form 8832 – Entity Classification Election allows LLCs to elect to be taxed as a corporation, which means they will be taxed as a c-corp. In some cases, electing to be taxed as a corporation can lower the LLCs tax bill.

The LLC will have to file a corporate tax return, separate from the member’s personal taxes. This is done by submitting Form 1120 to the IRS.

S-Corp

Similarly, an LLC can opt to be recognized as an S-Corporation by filing Form 2553. S-Corp is a special designation granted by the IRS, which allows the profits and losses from businesses to pass through to the members.

The difference between an S-Corp and other pass-through entities is in the way the members file self-employment taxes. For a single-member or multi-member LLC, the IRS requires owners to pay taxes on 100% of their profits, whereas S-Corp members pay taxes only on the salary or wage they receive from the business.

For example, let’s consider that the owner of a single-member S-Corp reports $200,000 in profits from the business. As an employee of the company, the owner takes a reasonable income of $80,000 from the business.

Under the taxation guidelines for s-corporations, this means that the owner will pay the mandated 15.3% in self-employment taxes on their $80,000 salary. The remaining profits will not be subjected to these taxes. However, there are payroll tax returns, payroll processing etc. to be considered.

Along with Form 1120S, the S-Corp owners will also receive individual Schedule K-1s to file alongside their personal tax returns.

State Taxes

LLCs are taxed on similar terms across most states i.e. taxes are reported on the owners’ personal tax returns. The LLC itself does not pay the state taxes separately.

With that said, there are some states such as California that levy a tax on LLCs that earn a specific amount of annual income. Furthermore, a few states including Wyoming and Pennsylvania impose annual fees on LLCs. This is known as franchise tax, annual registration fee or renewal fee. Check the relevant guidelines on your state’s Revenue and Tax Department website.

Final Thoughts

How does an LLC pay taxes, without its members feeling overwhelmed and confused? Varying taxation systems benefit the LLC business and owners in different ways. LLC business structures enjoy a relatively simple taxation system. Single and multi-member LLCs file Form 1040 along with Schedule C and K-1 respectively. C-corps submit Form 1120 while S-Corps file Form 1120S and Schedule K-1s.

Every business has different tax requirements based on its legal structure, which continues to change as the business progresses and increases its profitability. This article’s purpose is to give you a brief yet comprehensive look into how an LLC under different forms of management would pay taxes.