What forming an LLC in Nebraska can do for you

Forming an LLC (Limited Liability Company) in Nebraska has many advantages. In doing so, you will not only create a sense of legitimacy for your business, but you will be able to take advantage of a hybrid corporate structure.

- Pass-through taxation: the LLCs profits and losses flow through to the individual members. You will not be double-taxed on your LLCs income and then again on the income that you make from the LLC. The LLC’s taxes flow through to the individual members’ tax returns. You can also elect to have a corporate taxation structure for your LLC.

- Limited Liability means your personal assets (bank account, investments, house, car, etc.) are protected in the event of litigation or debt collection against your LLC.

What is an LLC used for?

- Running a business

- Owning property

- Owning other corporations,

- Purchasing and owning assets

Forming a Nebraska LLC in a nutshell

Forming an LLC in Nebraska includes 5 basic steps:

- Name your LLC

- Choose or hire a Registered Agent

- File the Articles of Organization with the State

- Create an Operating agreement

- Get an EIN (for banking and hiring)

Depending on your business needs, a few more steps could be added to the list such as opening a corporate bank account, getting a domain and website and hiring a tax professional.

Step 1: Naming Your LLC

The first important step in LLC creation is to name your LLC. If you will be using the name publicly as a storefront or as part of a website, for example, consider if the name conjures up something meaningful someone that would be interested in your services. Also, consider the SEO value of your particular business name.

Your LLC name and your business name (a website, store or service company) don’t have to be the same. During the LLC formation process, you can establish your DBA (Doing Business As), and even run several business venture DBAs under one LLC.

1. Follow the State’s best practices when naming your LLC

- The LLC name must include one of its abbreviations in capital letters (LLC or L.L.C.) or the phrase “limited liability company”.

- The name of the LLC must not contain any words that could make it look like a state agency such as State Department, Police, FBI, etc.

- You may have to file additional paperwork in order to use words like MD, Lawyer, Bank, etc. One of the LLCs members may have to provide proof of professional licence in order to include such words in the LLC.

2. Search the Nebraska State website to see if your desired LLC name is available

The Corporate Division on the Nebraska State Website enables you to search for your desired LLC name using a “starts with”, “exact match” or “contains” function. There are many other parameters that you can use to refine your results.

Even if you haven’t settled on a name, it is worth checking out the site. You’ll be able to familiarize yourself with the search functions and to find out who your competitors are.

3. Choose and secure the same domain name for your LLC or DBA

A quick search on NameCheap.com will let you know if the prospective domain is available. Use the search bar below to perform a search right on llcwisdom.com.

Even if you don’t plan on creating a website for your business right away, we recommend that you secure your domain name, especially if it is an exact match.

Find a domain starting at $0.88

powered by Namecheap

If you’re ready to host your site, NameCheap has some incredibly affordable hosting packages. With a 1-click WordPress installation, you can get your business site online in just a few minutes.

Step 2: Get a Registered Agent

In order to form a Nebraska LLC, you will have to appoint a registered agent. You must list the Registered agent for your LLC in your Articles of Organization document.

What is the role of a registered agent?

- A registered agent is the first point of contact between your LLC and the State. A registered agent other than yourself adds a layer of privacy because all correspondences like legal documents, tax forms, lawsuit notices and service of process will be received by your registered agent.

- Your registered agent will receive annual report notices on your behalf. A registered agent is there to make sure that you are notified of all annual filing and reporting deadlines.

- Your registered agent must have a physical street address in Alaska. Any legal documents sent by the state are sent to this address. A registered agent must be available during business hours. Your registered agent cannot use a P.O. Box to send and receive mail.

Having trouble finding a Registered Agent?

Zen Business can act as your Nebraska registered agent service for free along with their introductory full service LLC formation package ($39 + state filing fee).

Alternatively, you can get a Nebraska Registered Agent through Zen Business for $119 per year.

Who can act as your Registered Agent?

When you appoint a registered agent, you have 3 options:

-

- Hire a registered agent service like Zen Business.

- Appoint a trustworthy person or entity to act as your LLCs Registered Agent. (Must be open/available during regular business hours).

- Nominate yourself or another member of your LLC as a registered agent.

Step 3: File Your LLCs Articles Of Organization

You can file the Articles Of Organization with the Nebraska Secretary Of State online, by mail or in person.

Online filing is the fastest option. Upon filing, you will have to pay the Nebraska state filing fee of $125.

You will need to provide the following details within your LLC’s Articles of Organisation:

- The name of your LLC.

- The name and address of your Registered Agent.

- A list of the services your LLC will offer.

- Pay the state filing fee.

- Whether the LLC will be member-managed or manager-managed.

Your LLC will most likely be member-managed. Manager-managed LLCs are entities in which there is a large number of members who do not wish to be involved in day-to-day affairs of running the entity. In this case, the members of the LLC appoint a manager to make decisions on their behalf.

Step 4: Operating Agreement

Although not mandatory in Alaska, it is recommended to make an Operating Agreement at the time of the LLC’s formation, especially if there are multiple members.

Advantages to creating an operating agreement:

- This document will define who the members are and what percentage of the LLC they own if the LLC has more than one member.

- Having an operating agreement helps to prevent future conflict by establishing a management structure.

- Defines each member’s rights, roles, and obligations in the case of a multi-member LLC.

- Adds robustness to your LLC during a legal dispute. The operating agreement is proof that you are operating the LLC as a separate legal entity.

- Details what will happen if your LLC is dissolved.

Download free operating agreement templates and start working on your operating agreement today:

- Single-member operating agreement

- Multi-member (member-managed) operating agreement

- Multi-member (manager-managed) operating agreement

Step 5: Get an EIN

EIN stands for Employer Identification Number. An EIN is also referred to as a Federal Tax ID number.

An EIN is a form of Taxpayer Identification Number (TIN) in the United States. It works in the same way as your Social Security Number (SSN) by and acts as an identifier for the IRS.

Having an EIN will facilitate many operations regarding your LLC.

Why it is a good idea to get an EIN right after you form your LLC:

- It helps the IRS identify your business for tax purposes.

- Enables you to more easily open a business bank account under your LLCs name.

- Enables you to hire employees and/or contractors and adds credibility to your organization during billing.

- Speeds up the process of applying for a business loan.

- Protects your personal identity because you will not have to use your Social Security Number SSN for certain transactions.

- Enables you to apply for certain licences and permits.

Where can I get an EIN for my LLC?

You can obtain an EIN for your LLC free of charge from the IRS. You can apply for your EIN after you have received your incorporation documents from the Nebraska Secretary of State.

Get your free EIN on the IRS website.

How can LLC formation services save you time, money and added stress?

An LLC formation service will not only save you time but can eliminate a piece of the puzzle that is the most complex for start-ups: finding a Registered Agent.

It is challenging to find someone that has sufficient know-how and trustworthiness to take on the role of a registered agent for your LLC. The registered agent criteria are also quite daunting for most people.

Basic LLC formation packages take care of the following tasks so that you can focus on growing your business:

- Filing your Operating Agreement.

- Filing your Articles of Organization

- Acting as the Registered Agent in the state where you form your LLC.

- LLC name availability search.

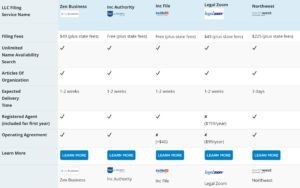

| Filing Fees | $49 + state fee | $49 + state fee | $49 + state fee | Free + state fee | $49 + state fee | $225 + state fee |

| Unlimited Name Availability Search | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Articles Of Organization | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expected Delivery Time | 1-2 weeks | 24-hour processing, Free Express Shipping | 1-2 weeks | 1-2 weeks | Within 1 week | 3 days |

| Registered Agent (included for first year) | ✔ | ✔ | ✘ ($159/year) | ✔ | ✘ ($149/year) | ✔ |

| Operating Agreement | ✔ | ✘ | ✘ ($99/year) | ✔ | ✘ (+$35) | ✔ |

Compare the best LLC formation services that you can use to reduce stress, save time and get back to growing your business or organization.

What To Do After Forming An LLC?

1. Get a Business Bank Account

After you receive your incorporation documents from the Nebraska Secretary of State and that you have obtained an EIN for your LLC, you will be able to open a business bank account. You will also be able to obtain a business credit card, but this depends on your personal credit score.

Advantages of having a business account

- A business account facilitates the management of your LLCs finances.

- By keeping your personal and business transactions and assets separate, you will ensure liability protection for your personal assets.

- It is much easier to declare tax-deductible expenses when they appear on your business bank account/credit card.

2. Apply for the proper business licence

Depending on the type of business you are running you may have to apply for a business licence.

Check with your local municipality or state to find out if you need a business licence to operate.

Business Licence Examples include:

- General business operation licence

- Zoning permits

- Professional licence ex: tradesman or health professional.

- Health department permit

- Seller’s permit

- Home occupation permit (artist, hairdresser, councillor, tutor).

3. File An Annual Report For Your Nebraska LLC

All LLCs in Nebraska must file an annual report with the Nebraska Secretary Of State regardless of the number of profits/losses it has incurred throughout the year.

There is a $35 fee to file an annual report.

Annual reports for Nebraska LLCs are due between January 1st and March 31st.

You can fill out and submit the annual report for your LLC on the Nebraska Secretary of State’s website.

*Important: if you do not submit your annual report on time, the Nebraska Secretary of State will change your LLCs status from “in good standing” to “terminated”.

There is a $25 penalty fee for each late annual report. A qualified registered agent service can keep you out of hot water by letting you know of all the duties and deadlines you meet in order to keep your LLC in good standing.